Can Trident become a multibagger stock in 2 years?

To become a multi-bagger at least one of the conditions (listed conditions not exhaustive) should be satisfied:

1/ The stock is trading at a very cheap valuation.

2/ A lot of growth can happen with good ROIC.

We see that neither of the conditions appears to be met. The stock is expensive and the returns are abysmal.

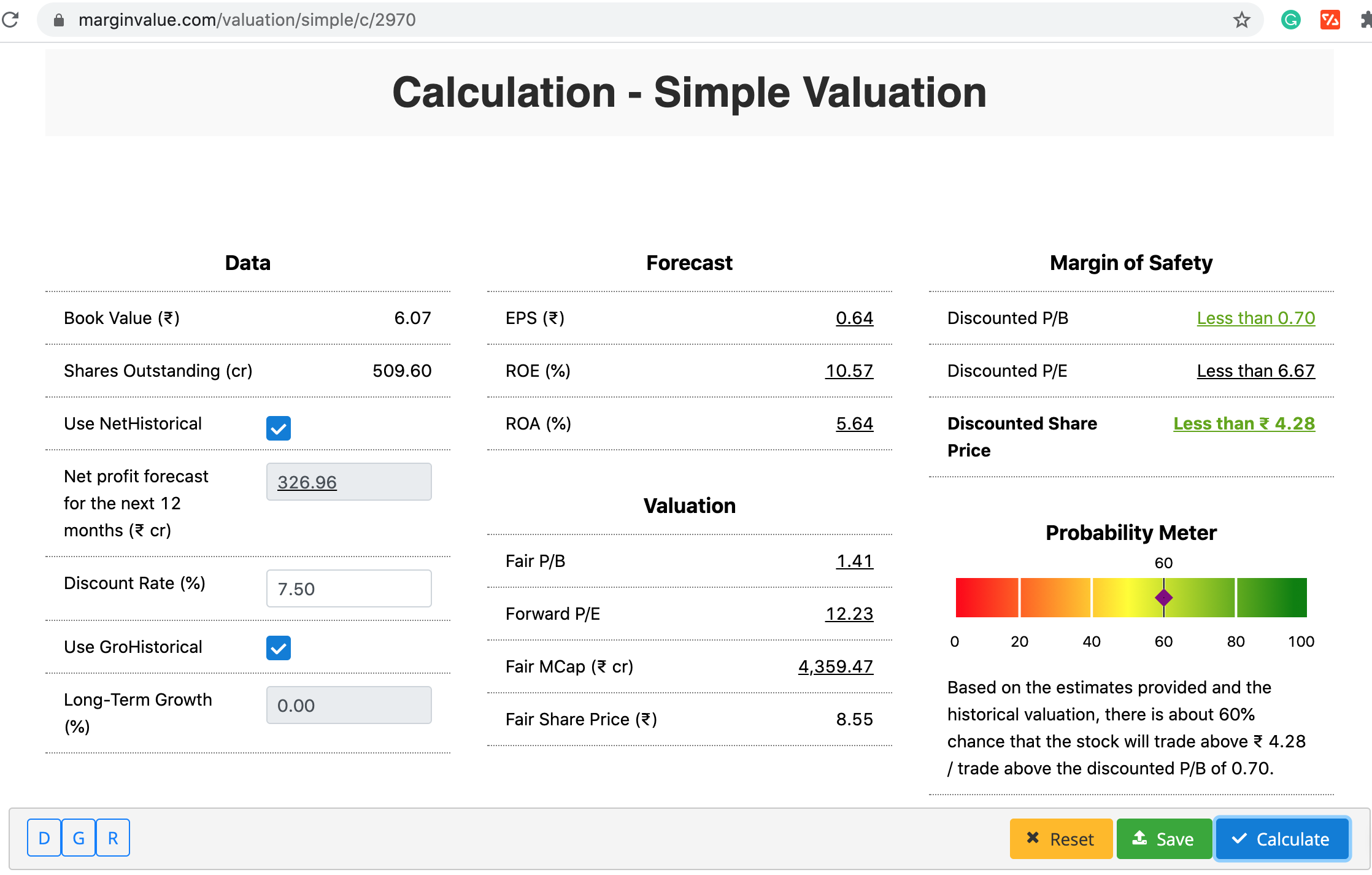

Using the Simple Valuation tool at MarginValue, I have calculated the fair value of Trident, the margin of safety, and the probability that the stock will trade above the valuation given under the margin of safety. You can attempt your own valuation.

#Trident #value #multibagger #investments #Stock

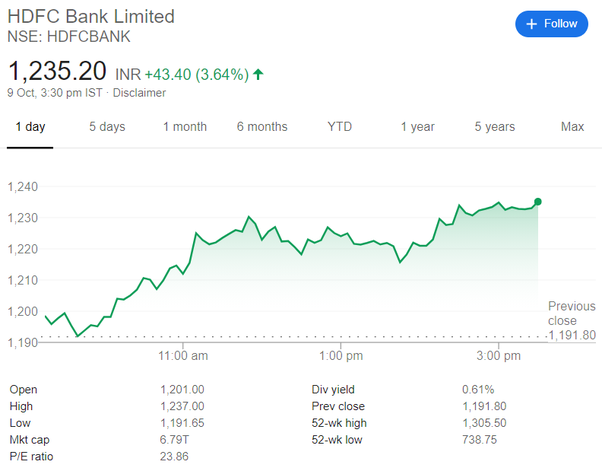

Why should I buy 10,000 shares of HDFC Bank for long term investment?

HDFC BANK IS A PROVEN MULTIBAGGER.

I don’t think that HDFC bank has ever disappointed anyone apart from huge Market correction.

Why you Should hold the stock?

1. The Financial Trend has been positive every quarter since we started tracking 20 quarters ago.

2. HDFC Bank continues to register high-profit growth while keeping its Non-Performing Assets (NPA) very low and very high return ratios.

3. The Gross NPA based on March 2019 numbers is 1.3%. This is against close to 10% of the Gross NPA of SBI reported in Dec 2018. The corresponding number for ICICI is around 8%.

4. The ROA of HDFC Bank continues to be high at around 1.8% vs ICICI’s of 1.5% and SBI’s 0.4%

Motilal Oswal Securities in a recent report has articulated very well that HDFC Bank is ready to capitalize on the growth opportunities due to the following factors:

• CASA ratio of 43.5%,

• Opportunities’ for the significant market share gains

• Improving operating efficiency led by digitalization initiatives

• Expected traction in income due to strong expansion in branch network, and

• Best-in-class asset quality

When to sell?

Philip Fisher famously said, “If the job has been correctly done when a stock is purchased, the time to sell it is — almost never.”

However, he did provide a framework for selling a stock. He says one should sell a stock if “the reasons you bought the stock are no longer valid”

This could happen mainly for the following two reasons “either there has been a deterioration in the management quality of the company or the company cannot sustain the growth”.

My View on HDFC BANK is very very BULLISH for long-term investments.

#HDFC #Bank #longterm #investments #HDFCBANK #Stock #sharemarket #bullish

Multibagger recommendations for 2020?

Who doesn’t want to hold multi-bagger stocks but finding such stocks are difficult and holding on for 10–15 years is another task but let me know help you with some stocks which have the potential of becoming multi-baggers.

After some research, I have found that some of the stocks can become multi-bagger in 10–15 years.

Long term investors can invest in the following stocks:

1. Sterlite Technologies - Telecommunications

2. Delta Corp - Gaming and Hospitality

3. Bajaj Finserv - Financial Services

4. Borosil Renewables - Solar

5. Atul Limited – Chemicals

Again these won’t give you multi-bagger in the short term, but for the long term, this list will definitely have a few.

Let me explain with one example why I considered these stocks multibagger:

Sterlite Technologies (STL) is a digital technology company with offices in India, China, US, SEA, Europe, and MEA. It is listed on the Bombay Stock Exchange and National Stock Exchange of India. It has 358 patents and is active in over 150 countries.

STL design, build and manage data networks for customers. With core capabilities in optical connectivity, network and system integration, and virtualized access solutions, STL are the industry’s leading end-to-end solutions provider for global data networks. STL partner with global telecom companies, cloud companies, citizen networks, and large enterprises to deliver solutions for their fixed and wireless networks for current and future needs.

With an intense focus on end-to-end network solutions development, STL conducts fundamental research in next-generation network applications at their centers of Excellence. STL has a strong global presence with next-gen optical preform, fiber, and cable manufacturing facilities in India, Italy, China, and Brazil, along with two software-development centres across India and one data centre design facility in the UK.

It has the first optical fiber cable plant in India to receive zero waste to landfill certification.

Optical Fiber and Accessories Market in India to Hit $1.66 Billion by 2026, at 17.2% CAGR: AMR

Widespread implementation of 5G, the surge in adoption of fiber to the home (FTTH) connectivity, and the emergence of the internet of things (IoT) drive the growth of the India optical fiber and accessories market. By the end-user, the telecommunication segment held nearly half of the total market share in 2018. On the other hand, by geography, the East region is projected to grow at the fastest CAGR of 23.3% during the study period.

Source: Allied Market Research

Why India needs a fiber network now more than ever?

According to a Nokia Mbit 2018 report, 4G consumption per user (there are 420 million of them) reached 11 GB per month in December 2017, of which video content contributed up to 65 percent of the total mobile data traffic. While this massive uptake of data has been driven by smartphones, optical fiber networks are crucial for securing India’s broadband future. As data consumption keeps growing exponentially and with new technologies such as 5G on the way, wireless platforms will not be enough to meet the demands of bandwidth-guzzling consumers.

“To deliver internet reliably and deliver bandwidth-hungry applications such as live streaming coaching classes, fiber is the most suitable medium for carrying a high amount of data over long distances,” said an industry analyst. While the case for fiber optics has existed since the late 1990s when companies such as HFCL started laying fiber, the economies of scale seem to make sense only now. Fibre investment in India has been low as the telecom operators relied on 2G technology for voice penetration and data. China consumed 13.7 times more fiber than India in 2016.

Source: TheHinduBusinessline

Sterlite Technologies, which deals in fiber optic cables, has several tailwinds going for it: government initiatives such as Digital India and Smart Cities, the expectation of exponential data growth, and 5G deployment the world over.

Now, all these are past news but the stock is available for cheap right now, and investing in this company for future prospects is such a good idea. Although, the vision is great but the company needs to post strong profits in order to justify the future price growth.

So, if everything works out in favor of STL, I think the stock can easily climb up to 500 from these levels in the next 5–10 years.