Why should I buy 10,000 shares of HDFC Bank for long term investment?

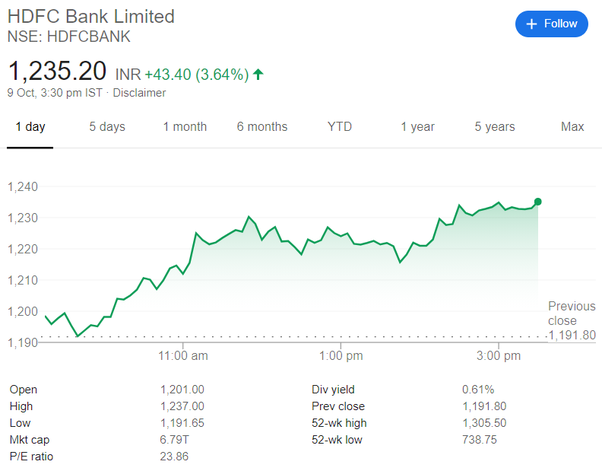

HDFC BANK IS A PROVEN MULTIBAGGER.

I don’t think that HDFC bank has ever disappointed anyone apart from huge Market correction.

Why you Should hold the stock?

1. The Financial Trend has been positive every quarter since we started tracking 20 quarters ago.

2. HDFC Bank continues to register high-profit growth while keeping its Non-Performing Assets (NPA) very low and very high return ratios.

3. The Gross NPA based on March 2019 numbers is 1.3%. This is against close to 10% of the Gross NPA of SBI reported in Dec 2018. The corresponding number for ICICI is around 8%.

4. The ROA of HDFC Bank continues to be high at around 1.8% vs ICICI’s of 1.5% and SBI’s 0.4%

Motilal Oswal Securities in a recent report has articulated very well that HDFC Bank is ready to capitalize on the growth opportunities due to the following factors:

• CASA ratio of 43.5%,

• Opportunities’ for the significant market share gains

• Improving operating efficiency led by digitalization initiatives

• Expected traction in income due to strong expansion in branch network, and

• Best-in-class asset quality

When to sell?

Philip Fisher famously said, “If the job has been correctly done when a stock is purchased, the time to sell it is — almost never.”

However, he did provide a framework for selling a stock. He says one should sell a stock if “the reasons you bought the stock are no longer valid”

This could happen mainly for the following two reasons “either there has been a deterioration in the management quality of the company or the company cannot sustain the growth”.

My View on HDFC BANK is very very BULLISH for long-term investments.

#HDFC #Bank #longterm #investments #HDFCBANK #Stock #sharemarket #bullish