Can you share your portfolio of stocks, if you are a long term investor?

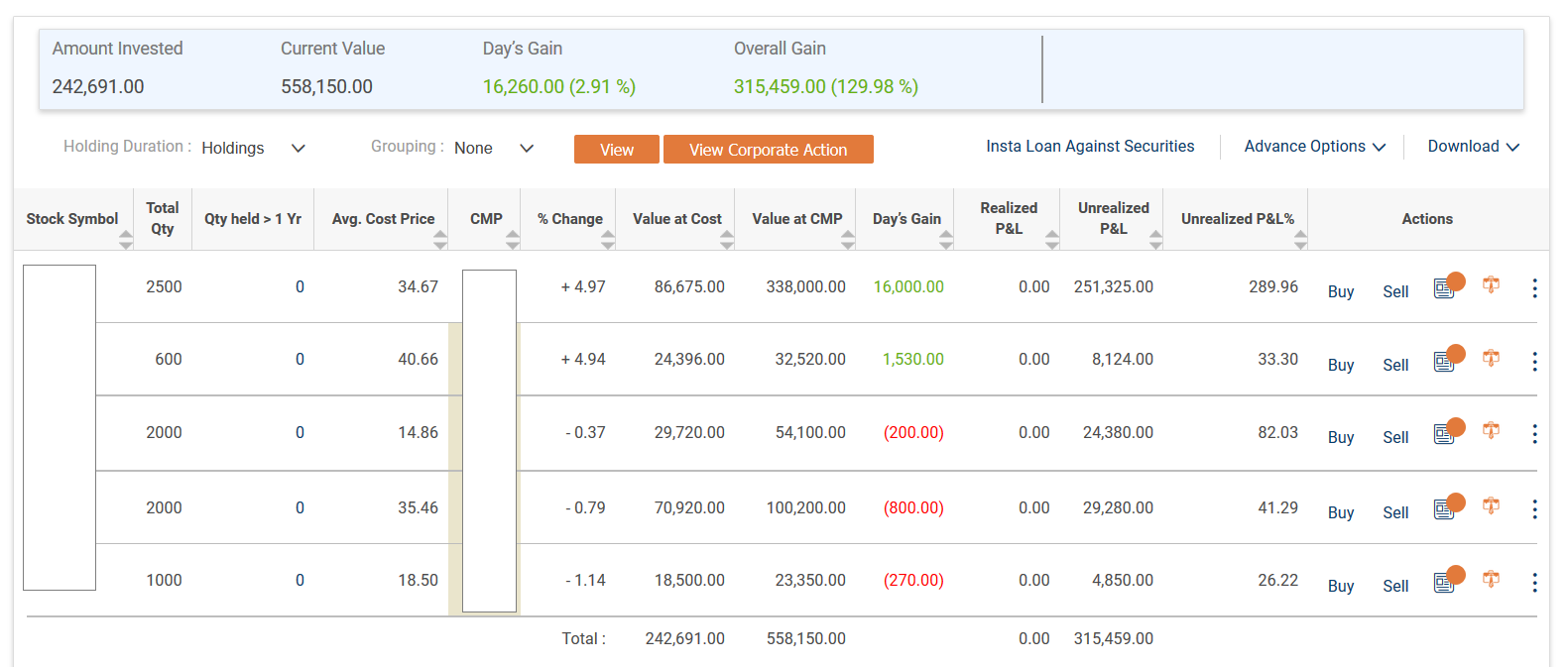

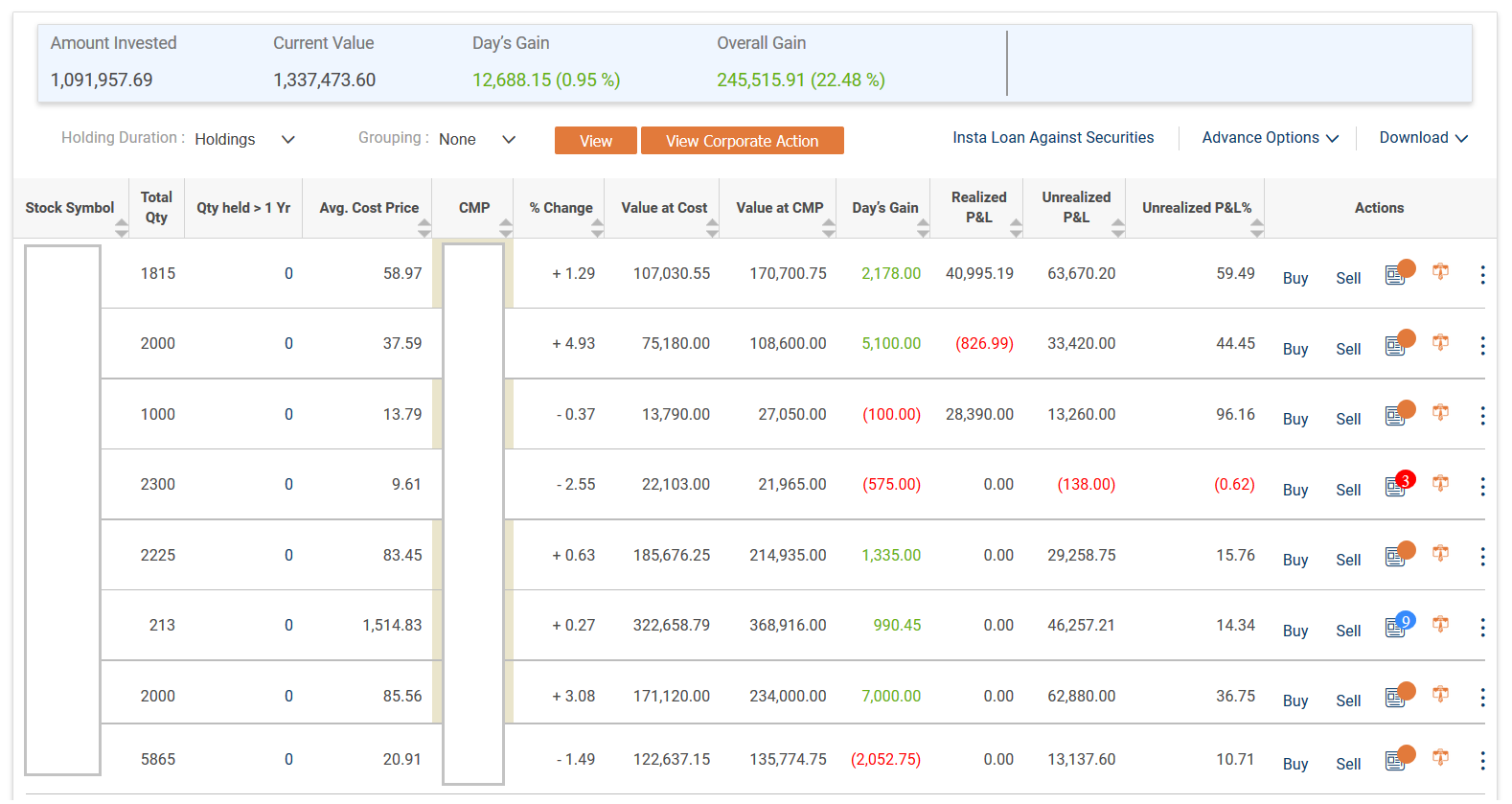

I invested around 15 lakh in March-April and has made around 7 lakh in profit in June 2020. If the 7 lakh vanishes in the next 5–6 months, I will not worry as I am a long-term investor. The goal is to sell my holdings (partially) after 10–15 years.

I always believe in the strategy: BUY RIGHT, SIT TIGHT. I have been around the stock market since I was 15 years old and started dabbling in markets with my father. I don't know every detail about the stock market, but I know enough to make money in the long term. My father had never made money in trading, in fact, he lost all the money he made in equity due to trading stocks.

Although, many believe trading is profitable and it might be, but if you're starting, NEVER TRADE. Start with understanding the markets and start investing slowly. You might think 1,000 rs is a small number to start but believe me, if you start investing now and increase the amount you invest monthly you will get RICH in 20 years.

#long-term #valueinvestor #investing #portoflio #rich #profits #Stock #Stockmarket

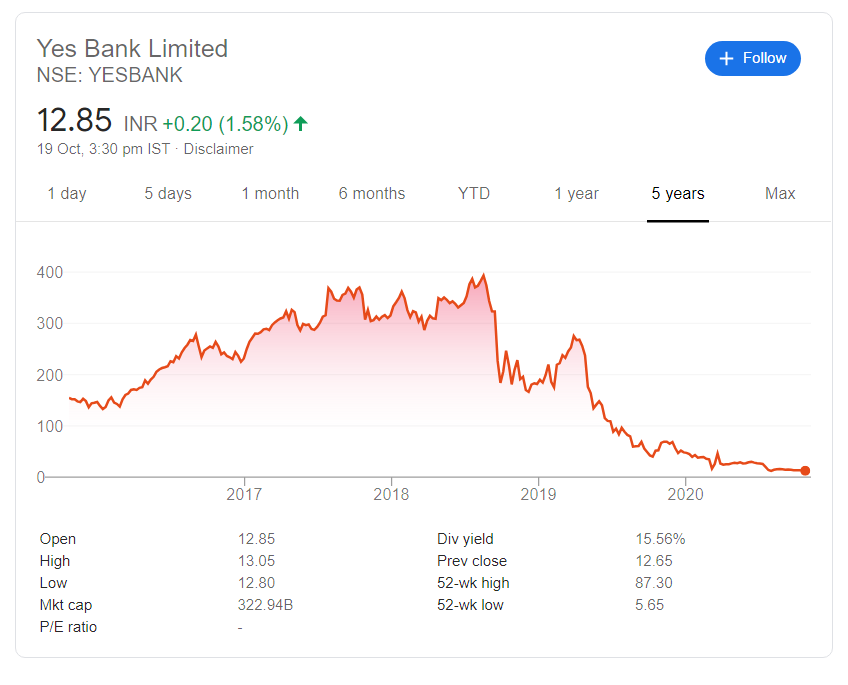

I am planning to buy 10,000 Yes Bank shares at 13.5. What are the chances of it reaching 135 in the next ten years?

Why do you want to invest in such stock? These stocks are very risky, and the past scam in YES Bank doesn't instill any confidence. Although the current management is brilliant but waits till the balance sheet is more attractive.

It's better to invest in other stock which may give you more than 20 times return in long run. This stock only has only a limited potential.

Avoid Yes Bank and don't think it's cheap.

Most of the time cheap stock isn't really cheap and this is one of the main reasons why retail investors lose their money in the stock market.

#Yesbank #Stock #Investment #Cheapstock